Money can be a sensitive subject with family members, especially as you age. However, it is important to intentionally have conversations about finances to ensure you have a voice in the way you would like your money spent. Having conversations around finances is more than just talking about spending money but also about whom you would like to assist you in managing your money, methods of paying specific bills, setting up an emergency fund, and ensuring your family members have a vision of your long-term care plan. It is vital to have these conversations before there is an emergency or crisis.

Here are some tips to help create a financial plan as you age:

- Designate a family member that you would like to help you with your finances.

- Explain clearly what you would like this role to look like

- Questions to think about as you think through which family member might be the best fit:

- Do you need help paying your bills or just someone to remind you to pay specific bills?

- Do you need someone to help monitor your savings and checking accounts?

- Do you need someone to plan for the future and ensure your finances are in a stable position?

- Questions to think about as you think through which family member might be the best fit:

- Explain clearly what you would like this role to look like

- Explain how involved you would still like to be in terms of conversations regarding your finances.

-

- Are there specific ways you would like to spend your money as you age?

- Do family members know about any retirement accounts and what is outlined in your will?

-

- If you want to continue to manage finances, are there supports you can set up to help you?

-

- Can you set up reminders on your phone or on a calendar when you have monthly bills due?

- Can you set up automatic payments for some of your recurring bills?

- Several companies have the option to set up monthly payments online and this helps eliminate having to remember specific bills.

-

- Determine if you qualify for any waiver programs such as CHOICES.

Tennessee CHOICES is a “program that includes nursing facility services and home and community-based services (HCBS) for adults 21 years of age and older with a physical disability and seniors (age 65 and older).” You can learn more about TN CHOICES and the qualifications. This might be a way to supplement some of the income you already have and help you continue to get care in your home.

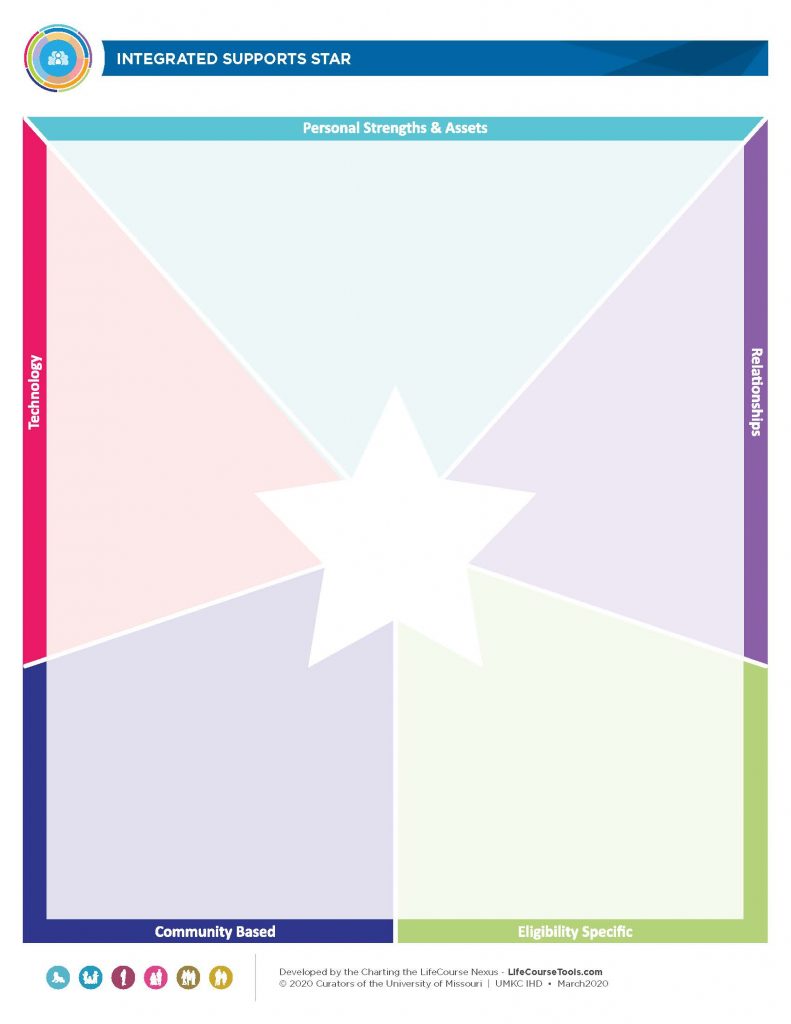

Another tool that might be helpful to fill out with family members is the Integrated Support Star from LifeCourse Nexus. This tool helps you think through all the supports you already have in place and other ways support might be given. It is a great tool to help you think through all the areas where you might need financial support or places where you are already managing different aspects of your finances. Click the picture below to view the support star. There is also a tip sheet that explains how to use it effectively.